Our customers must undertake :

1- to comply with the regulations, particularly tax regulations, of the country in which they set up their company, as well as those of their country of tax residence,

2- to carry out a real economic activity in the country where they create their company and to organise their economic substance in the said country,

3- to pay tax in their country of tax residence,

4- not to organise tax fraud or evasion, money laundering or any other illegal activities.

Any customer in breach of these undertakings is solely and entirely responsible for their actions.

See also our special terms and conditions of sale (click here)

Disclaimers, privacy policy, terms and conditions of use and sale:

*By using our services, you undertake to operate within the law and not to seek a way of avoiding your tax obligations. Legality: it is legal to set up a cross-border cross-border cross-border company in Europe (in or near the European Union), particularly in application of the Hague International Convention (Decree 92-521 of 16 June 1992), which established that “Any natural or legal person resident in the European Community has the right to set up a company in the country of his choice without having to be resident there for tax purposes”. However, to set up and manage a cross-border company in Europe (in or near the European Union), there are rules to be complied with, particularly with regard to the country of tax residence of the beneficial owner(s) (shareholders). We do not give any legal or tax advice; you should take advice from a tax lawyer and an international trade lawyer before ordering an offshore company from us. The creation of an offshore company is your property if you are the beneficial owner: as such, you are accountable to the authorities in your country of tax residence, even if you only own part of the offshore company. Before ordering the incorporation of an offshore company, you should consult a tax lawyer; we do not provide tax advice. As the owner of an offshore company, your tax obligations will be to comply with the tax regulations of your country of tax residence. It should be emphasised that operating a fictitious cross-border company in Europe (in or near the European Union) exposes you to a tax reassessment in the owner’s country of tax residence, and that invoices issued by a fictitious cross-border company in Europe (in or near the European Union) are so-called “convenience” invoices, constituting a criminal offence. Please note: the taxation of an LLP may be requalified, depending in particular on the tax rules of your country of tax residence and the activity and organisation of your LLP: you should consult a tax lawyer before placing an order for an LLP. The owner of an extra-territorial (or cross-border in Europe) company must declare his company to the tax authorities in his country of tax residence. Members of an LLP must pay tax in their country of tax residence. The appointment of a director, officer or member does not exempt the owner(s) of a cross-border company in Europe (in or near the European Union) (in or near the European Union) from complying with the legal requirements of their country of tax residence, in particular as regards tax transparency*. In the event of the appointment of a manager, director or member through a third party, and although we cannot be responsible for the legal and tax environment of our clients, we reserve the right to cancel this appointment, without prejudice to the client or compensation on our part, in the event that we become aware of a defect, breach or inconsistency (declaration, due diligence, KYC, KYB, etc.). Such a cancellation cannot be reinstated if the customer has been warned of the defect, breach or inconsistency and has not resolved the problem within eight days of the warning, regardless of the method by which the warning was given.The name of the manager, director or member will then be replaced by the customer’s name and contact details.

*Company incorporation in a maximum of 2 days, in the UK only. We create your extra-territorial company only, and you organise your business at your convenience and under your sole responsibility. You alone organise your business, which makes it a European business (company and company owner in the same country) and or cross-border business in Europe. Together with your chartered accountant and tax lawyer, you manage your professional and personal tax obligations, which are specific to your country of tax residence. We never intervene or advise you on your tax situation, which depends on various parameters: country of tax residence, activity in Europe (company and owner of the company in the same country) and/or cross-border activity in Europe, as well as other parameters that we do not know about your profile and your activity. We are not responsible for the use you make of your company, as our work is limited to setting up your extra-territorial company in the country (jurisdiction) you choose. The tax exemption applies only in the country that decrees this deregulation and not in the country of tax residence of the beneficial owner (shareholder) in which the latter must pay all his personal and professional taxes. You must pay tax on income, profits and dividends in your country of tax residence. In the case of activity in Europe (company and company owner in the same country) and or if you are an expatriate, certain obligations may be different. Subject to the legal and regulatory provisions of the beneficial owner’s country of tax residence. Failure to comply with the rules laid down by the beneficial owner’s country of tax residence will result in the company being taxed in that country. The situation of each company and beneficial owner is different, depending in particular on the location of the company and the country of tax residence of the beneficial owner, and what may work for someone in one country may not work in another. Customers are solely responsible for the use they make of their company. You must pay income tax in your country of tax residence. We expressly invite you to consult a tax lawyer and a chartered accountant so that you can organise your business perfectly in the country where you want to set up your company. The basic principle in setting up an offshore company is to create a real business. We are not tax advisers and do not give any advice whatsoever, either on this site or by telephone. Our business is to sell a Company incorporation service and in no way to optimise tax. The general information expressed on this website is subject to all reservations regarding the legal texts applicable, country by country, at the time of publication of the said information; the information on this site may be incorrect, may only apply in a single country or territory or may no longer be applicable. The language used on this page and on this site does not correspond to a particular country but to a translation. Photos are non-contractual *Up to minus 95% (holding).

*Contact us. The bank will accept your application as soon as it has received the documents requested by the organisation and subject to your eligibility.

*Caution: the taxation of an LLP may be requalified, depending in particular on the tax rules of your country of tax residence and the activity and organisation of your LLP: it is your responsibility to consult a tax lawyer before ordering an LLP. Your LLP’s activity must be genuine in the country in which it is established, specific to a category of activity such as intellectual property, etc. The members of an LLP company must pay tax in their country of tax residence.

*Shareholders of a Company in Europe (in or near the European Union) must pay income tax, dividend tax and/or flat tax in their country of tax residence. In the event that the Company in Europe (in or near the European Union) lacks economic substance (absence of a place of business (premises, offices), physical presence (employees) and material presence, activity, etc.), the shareholders will pay corporation tax in their country of tax residence and at the tax rate of their country of tax residence.

Invoices issued by a company that has no economic substance, no real establishment, no physical or material presence, no activity, etc., are prohibited by the tax authorities; their use is reprehensible.

*The creation of a bank account by a third party is illegal, even with a power of attorney; we invite you to be wary of sites offering to open a bank account for you. A bank introduction* is a contact, via an Internet link (URL), with a neobank or physical bank; it does not in any way mean or guarantee that a bank account will be opened. The customer is required to provide the documents requested by the banking organisation (neobank or physical bank), which alone decides whether or not the applicant is eligible for a bank account. Please note that we do not, of course, create bank accounts, nor do we advise any bank on tax optimisation. Our bank introduction* service is only available to our business customers; the connection, therefore, is only for companies in Europe (no tax optimisation) and we are not involved in the creation of the bank account. The bank has the sole right to decide whether or not to open a bank account (art. L. 312-1, II CMF). The profile of the applicant for a bank account and their eligibility to open a bank account are decisive factors in the bank’s decision. A business plan (and/or website), a forecast, a professional CV, a banking history and/or recommendation may be requested; proof of identity and residence will also be required. For a Barclays or HSBC bank introduction*, you must speak English and travel to London will be required.

We do not open bank accounts or offer tax optimisation; we have no interest in the online or physical banks listed on our website. Only the banks accept or reject a customer. Any bank account outside the holder’s country of tax residence must be declared by the holder to the tax authorities in his or her country of tax residence; for France, here is the form for declaring a foreign bank account: https://www.impots.gouv.fr/formulaire/3916/declaration-par-un-resident-dun-compte-letranger-ou-dun-contrat-de-capitalisation-o

*Some of the information contained on this page may be erroneous over time; it is therefore non-contractual and deemed to be provided for information purposes only. Readers should check with a lawyer specialising in tax, commercial, business or international law to ensure that the information they are reading is still up to date at the time they read it.

*Accounting: we don’t do the accounting ourselves, we put the customer in touch with a firm of chartered accountants who invoice the end customer directly for the accounting.

Subject to change without notice; please check with your tax advisor, who is independent of this website. We are not tax advisers and the information expressed on this website is subject to the application of the legal texts at the time of publication of the said information; the information on this website may be incorrect, may only apply in a single country or territory or may no longer be applicable. All tax residents must pay income tax in their country of tax residence. Non-contractual photos

**https://www.academia.edu/30241914/PERTINENCE_%C3%89CONOMIQUE_ET_IMPERTINENCE_JURIDIQUE_DE_LA_LUTTE_CONTRE_LING%C3%89NIERIE_OFFSHORE_DANS_UNE_PERSPECTIVE_DE_SORTIE_DE_CRISE

Personal information

The website operator is committed to respecting your privacy and protecting your rights when using this website. However, in order to provide you with the services offered on the site, the website operator must hold some of your personal data (only the information required to respond to your requests).

Use of personal and third-party data

The website operator will not use your personal data (including your e-mail address) for commercial or direct marketing purposes, and will not disclose this information to outside organisations, except with your express permission or in special circumstances. The website operator may therefore disclose confidential information about you only in response to legal proceedings, a court order or a subpoena.

Cookies and IP address

Cookies are small text files in which the provider of a web page or an advertiser stores data important to them in order to facilitate and improve navigation on the website.

When you browse our site, information relating to your browsing may be recorded or read in “cookie” files installed on your computer, tablet or smartphone.

Cookies are used for :

The cookie information banner.

The display of the information banner on the presence of cookies and your cookie management options on our site is managed by a cookie. The purpose of this cookie is to enable the information banner to be displayed on your first visit to the site.

Compiling statistics

Cookies enable the website operator to track the number of visits to the site, the number of pages consulted, the browser used, etc. This information is used to improve the site (ergonomics, etc.). This information is used to improve the site (ergonomics, etc.). This data is not personalised.

Improve the technical functions of our site

Cookies are used to change the language of the website.

Offer you advertising tailored to your needs

Cookies are used to analyse your centres of interest in order to offer you personalised advertising.

How do I delete cookies?

You can deactivate cookies. Your browser can also be configured to notify you when cookies are stored on your computer and ask you to accept them or not. Please note that these settings may affect your access to website services requiring the use of cookies.

You can deactivate cookies by following the instructions below:

For Internet Explorer:

In Internet Explorer, click on the “Tools” button, then on “Internet Options”. In the “General” tab, under “Browsing History”, click on “Settings”. Click on the “Show files” button. Click on the “Name” column heading to sort all the files in alphabetical order, then scroll through the list until you see files beginning with the prefix “Cookie” (all cookies have this prefix and generally contain the name of the website that created the cookie). Select the cookie(s) containing the name company-étrangère.com and delete them. Close the window containing the list of files, then click OK twice to return to Internet Explorer.

Details, update: see the browser help page: http://windows.microsoft.com/fr-FR/windows-vista/Block-or-allow-cookies

For Firefox:

Go to the “Tools” tab on your browser and select the “Options” menu. In the window that appears, select “Privacy” and click on “Show cookies”. In the window that appears, select “Confidentiality” and click on “Show cookies”. Locate the files containing the name fiduciaire-suisse.com, select them and delete them.

Details, update: see the browser help page: http://support.mozilla.org/fr.

For Safari:

Help page: In your browser, choose the “Edit & gt; Preferences” menu. Click on “Security”. Click on “Show cookies”. Select the cookies containing the name service-societe.com and click on “Delete” or “Delete all”. Once you have deleted the cookies, click on “Done”.

Details, update: see the browser help page: http://docs.info.apple.com/

For Google Chrome:

Help page: Click on the “Tools” menu icon. Select “Options”. Click on the “Advanced options” tab and go to the “Confidentiality” section. Click on the “Show cookies” button. Locate the files containing the name “service-societe.com”. Select and delete them. Click “Close” to return to your browser. “

For iPad:

Click on the Settings application

Select Safari in the left-hand column

Click Delete Cookies and then Delete

For Android:

Open the browser settings

Select Confidentiality and security

Click Delete all cookies and then ok

Modification and/or deletion of your personal data

You may change your personal details at any time or delete all information from our database. To do so, please contact the website operator as soon as possible. You will find his contact details below. If necessary, contact him at [email protected]

Security

The Website operator endeavours to take all necessary measures to protect the data collected (archived in particular with the suppliers LWS, Stripe, Google (non-exhaustive list), but cannot guarantee absolute security on the Internet. Indeed, when you publish personal information on the Internet, you expose yourself to the risk that a third party may intercept this data.

The website operator uses standard security protocols to provide the best possible protection for all transactions carried out on the website, provided by its suppliers (LWS, Stripe, Google (non-exhaustive list)). These include encryption, access control and network firewalls.

Your consent

By using the https://service-societe.com website, you agree to the privacy policy.

Modifications of the privacy policy

Any changes to the conditions stipulated in the privacy policy will be published on the https://service-societe.com website. Please use the same e-mail address if you wish to make a complaint.

General terms and conditions of sales

Site editor :

B’Compliance Advisory

18 rue Mirabeau, 54800 Jarny

SASU au capital de 10 000 €

RCS Briey 945 406 395

By using our website to order services, you agree to be bound by the terms and conditions and prices displayed on our website. These terms and conditions apply to the business relationship between the customer and us (as identified below) arising out of the customer’s request to us to provide certain specific services. Any order placed with us in one of our offices, over the Internet or by any other means, will constitute a binding agreement of these terms and conditions between the Customer and ourselves.

“Client” means the beneficial owner(s) of the business and/or the person(s) who have requested us to provide services. It also means any person whom the Customer may represent in the case of a group (all such persons jointly and severally). “Order Form” means the standard order form displayed on the https://service-societe.com website or any other format of the same form submitted to us by the Customer prior to the commencement of the order and provision of the Services by us. “Communication” means any communication between the Customer and us, by any of the following methods: (a) email or other message or form posted on the Internet; (b) SMS and or text message; (c) post or courier, any of the above being addressed to the last known or notified address of the recipient.

The Customer expressly accepts that we are subject only to an obligation of means and not of results. In the event that the company ordered by the Customer is refused by the company registration service in the country chosen by the Customer, the latter shall not be able to accept any liability on our part; however, other solutions shall be offered to the Customer: registration in another country at the Customer’s expense; we shall then be limited to only two attempts to register the Customer’s company. For reasons of legality and confidentiality, the Customer acknowledges and accepts that the bank introduction* service is a URL (Internet) link to an online bank and not a ready-to-use bank account. This bank introduction* is a service equivalent to an obligation of means and not of result; only the online bank can decide whether or not to accept a Customer.

The customer agrees to provide all the documents requested by our company for the creation or takeover of a company.

By ordering the Company incorporation service from us, the customer is expressly giving us a mandate to represent him or her administratively in dealings with a third party; we do not therefore intervene directly or legally.

The company’s management wishes to remain open to valid complaints, in order not only to resolve them efficiently, but also to improve its service as a whole. All complaints will be dealt with by the person responsible for the country of incorporation, but if you have a complaint that cannot be resolved, you can email our dispute resolution service: [email protected] to try and find an effective resolution.

Once you have ordered your company’s incorporation, we will do our best to process your order within minutes of receiving it, which is why it is difficult to cancel an order once it has been received. In the case of order cancellations, each request is unique and needs to be studied in detail.

It is your responsibility to provide us with an appropriate postal address, e-mail address and telephone number so that we can ensure administrative follow-up.

Although we can inform you to the best of our knowledge when you order services from us, we do so for information purposes only, without any commitment whatsoever; we do not give any legal, financial, accounting or tax advice, which you expressly acknowledge by visiting our site and ordering services from us. If you need advice, we recommend that you consult specialist lawyers. When you access our website, you will be asked to accept or reject our privacy policy, our website terms of use and our terms of sale: a link will allow you to read our privacy policy and our terms of use and sale. By accepting them, continuing your visit to our website and ordering a service from us, you accept our confidentiality policy and our conditions of use and sale without reservation.

We are not bound by any obligation of result regarding banking introductions and we do not guarantee that a bank will open an account for you. Factors such as economic conditions, your credit situation or your professional experience may prevent you from opening an account.

We will not be held responsible if you do not obtain credit or debit cards, cheque books, merchant accounts, letters of credit, Internet access or any other type of banking product for your company. Some banks may refuse outright to provide any of these services and we will not be obliged to find alternative solutions. We make no representation as to whether or not a bank will agree to open a bank account for you and we do not set up any bank accounts ourselves for our customers.

The service of administrator, director or member is offered for appointment reasons (missions, representation, project, etc.). You should consult a specialist lawyer before ordering our services, to find out whether you can use our services, particularly in your country of tax residence. We are not lawyers and cannot under any circumstances give you legal or tax advice. Our candidate agents, directors and members are legally independent and therefore not employees of our company. We only receive remuneration for putting them in contact with our clients. We do not interfere in any way in the relationships, assignments, representation or project(s) between our candidate directors, managers or members and our customers. We reserve the right to withdraw an agent, director or member from the public register if we become aware that the manner in which the business is being used or the very nature of the business may jeopardise the reputation, well-being or financial situation of an agent, director or member, without any possibility of reimbursement to the client for the nuisance he or she has caused.

We do not provide services for these activities: Websites with adult content, pornography, all activities related to the financial sector, all activities requiring a dedicated licence in the UK, Companies Alternative payment systems (E-pay), churches and charities, commodities trading (oil, diamonds, metals), crypto-currencies, financial services requiring a licence, BG, SBLC, MTN, financial instruments, futures trading, gambling, online casinos, insurance companies and brokers, mutual funds and hedge funds, pharmaceuticals (including dietary supplements), precious metals, securities trading, sale of fake diplomas, trusts, arms/weapons processing (non-exhaustive list). In any case, we are in no way responsible for the use that you will make of your company and we do not intervene in the management of your company, our activity being limited to the creation of your company and, possibly, the bank introduction*, i.e. the provision of a URL link to a neobank (online bank), so that you can ask the bank to open an account, the bank being the sole decision-maker as to whether or not to open your account; we do not intervene in any way in the process of registering and opening a bank account. You must register yourself on the online banking site to apply for a bank account.

We provide basic services relating to the registered office address (domiciliation) when we set up a company or if you transfer your company to our offices. The registered office address (domiciliation) is compulsory and is not included in the company formation pack, the additional cost is €490 + VAT/year, payable annually, half-yearly, quarterly or monthly, at the Customer’s choice and includes digital mail management, follow-up and support. Although this gives you the right to include our address on your stationery and business cards, unless you contract a superior service such as mail forwarding or other business correspondence or presence packages, the receipt of your mail will be strictly limited to official government and event mail up to a maximum of 10 pieces per year. Under no circumstances may our office be used without our consent for VAT registration, payroll, direct mail management or any type of administrative or commercial management. Any publicity of any kind that includes our address – other than simply mentioning your registered address or business cards – must be duly approved in writing by our offices. You may provide us with the address of your own registered office. In this case, we shall not be liable for any problems arising from the receipt of your mail, including mail from the authorities in the jurisdiction where your company is or will be incorporated.

If you plan to receive regular business mail at your address and or parcels, you will either have to pay for stamps, envelopes and handling charges, or buy a higher service package or an ad hoc service contract before receiving these mails and or parcels. In this case, you risk delays or rejection of your business mail and parcels. Depending on the type of service you have subscribed to, the mail will be held until you collect it, or scanned and sent by e-mail, fax or to the postal address you have given us. You are responsible for updating your mail information with our office. If your account is not up to date, we will keep the letters until the balance is paid. We reserve the right to open any letter sent to our office for verification and you accept this condition by using our service.

If we receive parcels on your behalf and they are too large to be handled practically, or if we are not informed, we will usually refuse them. If they are small or we are able to store them easily, we will accept them but will charge a handling fee depending on the weight, size and what we actually have to do to get the parcel to you. If your account is not up to date, we will hold parcels until the balance is paid. We reserve the right to open any parcel sent to our offices for verification and you accept this condition by using our service.

We offer a service called “Help with obtaining a VAT number”, which only concerns assistance with obtaining a VAT number; this service does not concern bookkeeping or VAT, tax, social security or other declarations; we are not an accountancy firm; this service of assistance with obtaining a VAT number concerns customers who have reached the legal threshold at which a company must register for VAT or for customers who must register for VAT as soon as their company is registered, in order to manage their business. It should be noted that in order to obtain a VAT number, new requirements have been laid down by European countries, namely (non-exhaustive list): organisation of an economic substance by the company (existence of premises, offices, human resources, activities, office equipment, etc.), in the country where the company is registered. For VAT registration, the following businesses will be refused: sale of mobile phones, second-hand cars, jewellery, precious metals, telecommunications minutes or telephone cards (non-exhaustive list). It is important to note that what you are buying is our expertise and support and not a guarantee that you will obtain a VAT number. We are under no obligation to obtain a VAT number and the final decision rests with the relevant authorities. To obtain a VAT number, you will need to purchase enhanced mail forwarding or business management services, or obtain your own office. We do not handle any accounting services, social security declarations, VAT, etc. We strongly recommend that you use the services of an appropriate accounting company.

For a ready-to-use company order: ready-to-use companies (already registered) may have been used and we give no guarantee, express or implied, concerning these companies. They are sold as is, as we have no control over these types of companies.

We reserve the right to subcontract all or part of the services we offer on our site to other companies and/or partners.

A company order is deemed valid for a minimum of one year: any changes during this minimum, incompressible period must be ordered exclusively from B’Compliance Advisory; during this period, the Customer may not request the Authentication Code.

All services, including the initial order and the annual renewal, are tacitly renewed at the end of the period for which they were contracted (i.e. for a period of one year). If you do not wish the service to be renewed, you must send us a registered letter with acknowledgement of receipt to B’Compliance Advisory, 18 rue Pastorelli, 06000 Nice, France, at least 90 days before the end of the contract (the date of your order being taken as proof), expressing your decision not to renew. In this case, the services will be deemed to be renewed for one year. Exceptionally, we accept any termination of contract, without prior notice, before the expiry of the anniversary date of the order, provided that the customer sends a registered letter with acknowledgement of receipt to the following address: B’Compliance Advisory.

When ordering a Company incorporation, we will ask you to provide a scan of proof of identity (passport or valid identity card) and proof of address (electricity, water, gas, fixed or mobile telephone, etc.) in the name of the director(s) and shareholder(s) of the company. The director may be a shareholder. Each director, shareholder and member must provide a scan of their passport or identity card and proof of address, as described above. The documents must be in PDF format. If necessary, you undertake, at our request, to provide us with a copy of your proof of identity, certified as a true copy by the town hall of your place of residence.

All prices are shown on our website, but we reserve the right to change these prices and conditions whenever we consider it necessary. Wherever possible, we will inform you of any changes in advance, but we are under no obligation to do so. In general, the terms and conditions shown on the website are the latest version and prevail over any other terms and conditions previously displayed or distributed. In the event of non-payment, we will refuse to send you information about the services you have ordered.

By identifying the officers and shareholders (or members) of the company, you fully warrant that you have the legal consent of those officers before appointing them and that you have verified that the information they provide to you is true and correct. In addition, if you are a professional intermediary, accountant or lawyer, you warrant that you have carried out minimum due diligence in accordance with the European Legal Directives and that you are able to provide this due diligence information on request.

We will provide services to you on the condition that you have provided us with true and accurate instructions, together with any documents requested; the absence of any information from you and of any document(s) to be provided by you is your sole responsibility: the order cannot be cancelled on the grounds that you have failed to supply the required information; no order can be cancelled once we have started work; no cancellation of an order for work that has not started is possible after the legal deadline; any order, any payment and any formal written document constitutes an order. You warrant that you are acting on your own initiative or that your customer has the authority to instruct us to do so. By identifying the officers of the company, you fully warrant that you have the legal consent of those officers to be appointed and you agree to indemnify us in the event of any dispute with the officers. You warrant the accuracy and completeness of the information you provide to us and accept all liability for the rejection of any document, account or filing due to inaccuracies or incompleteness. While we can provide as much guidance as possible, you are ultimately responsible for ensuring that the business name you choose is available for registration and can be used legally. We are not responsible for your choice of name. It is your responsibility to ensure that your choice of business name does not infringe any intellectual property or other rights.

We will take reasonable steps to ensure that our website is as complete and accurate as possible and to protect your privacy. Acceptance of our instructions is deemed to have taken place when we send an e-mail and not when you receive it. If the registry rejects your application or submission, you will have three days – at no additional charge – to resubmit the application with appropriate corrections. After that, we may choose to levy additional charges if we feel they are justified. We act as your agent.

We have no time obligation other than a reasonable time to provide the services. We will use our reasonable resources to meet the estimated times quoted on our website, but these are always estimates and we do not, in particular, accept responsibility for delays caused by third parties or for reasons beyond our control (such as unavailability of the World Wide Web, computer or telecommunications systems failure or failure of government systems or secure online payment gateways). We are under no obligation to accept any request or to continue to perform any service on your behalf. We reserve the right to reject any application or discontinue any service without liability.

In the case of a bank introduction* service, the Customer undertakes not to refuse to open the bank account proposed by the Bank. The Customer also undertakes to provide the Bank with all the supporting documents that the Bank deems necessary to obtain; the Customer may not contest the bank introduction* on the grounds that the Bank is taking a long time to instruct the Customer or on the grounds of the importance of the supporting documents requested. Where applicable, the customer shall bear full responsibility for the fact that he/she does not continue with the bank entry that he/she has begun and/or for his/her decision to refuse to open an account with the said bank; under no circumstances may he/she ask our company for other bank entries to compensate for his/her obstructions and/or refusals.

We are bound by an obligation of means and not of result: we obviously do not decide in the place and on behalf of the bank, which is the sole decision-maker as to whether or not to accept the opening of a bank account. Nor can we guarantee the bank’s response time.

Our bank introduction* service is limited to putting the customer in contact with the bank with which we ourselves have a relationship. This relationship is not necessarily a partnership. We have no control whatsoever over banking procedures, the timing of the banks and their responses. Here again, we are bound by an obligation of means (provision of a bank introduction*) and under no circumstances by an obligation of result (bank instruction and response times). In accordance with the regulations in force, a company applying to a bank to open a bank account must comply with the legal provisions, in particular those relating to compliance and KYC, KYB. Our banking introduction is limited to the provision by us of an internet link (url) enabling the customer to apply to a bank to open a bank account. Here again, we have an obligation of means and not of result as seen above. We demand total transparency from our customers with regard to the banks we have selected. We ourselves do not create bank accounts for our customers and do not sell banking services. Our bank introduction* service is limited to putting customers in contact with banks. We do not impose any particular bank on our customers; they can choose a bank themselves, without asking us. Our introductory banking service is transparent and neutral.

We don’t set up companies directly ourselves, and our bank introduction service is limited to putting customers in touch with banks: we don’t set up bank accounts.

We will not be liable to you for any breach of the terms and conditions or any failure or delay in providing our services through our site resulting from any event or circumstance beyond our reasonable control, including but not limited to failure of systems or network access, fire, explosion or accident or any other “force majeure event”.

We make no representations or warranties as to the accuracy, completeness or fitness for a particular purpose of the information and related graphics published on our site. The information published may contain technical inaccuracies, out-of-date material or typographical errors and is intended only as a general indication of our services. Our liability for any loss or damage (including compensatory, direct, indirect or consequential damages, loss of data, income or profit, loss of or damage to property and third party claims) arising from any single claim shall be limited to the value of the re-supply of the affected product or service.

We reserve the right to revise our terms and conditions, our range of services and the content of our site at any time without notice.

Due to the sensitive nature of commercial services, we reserve the right, at our sole discretion, to block access to our site and services without notice.

Outbound links to third party websites are provided for your convenience and general information. We do not guarantee the content, services or accuracy of these third parties.

All rights in the design, text, graphics and other material on our website, as well as in the layout and style, are protected by our own copyright or that of the relevant third party. Permission is granted to electronically copy and to print in hard copy portions of our site solely for the purpose of considering offers in connection with the purchase of goods or services on our website. Any other use of material on our site (including reproduction for purposes other than those noted above and any alteration, modification, distribution or publication) without our prior written permission is strictly prohibited and will be prosecuted to the fullest extent of the law.

The present general conditions of sale and our relationship shall be governed by and subject to the exclusive jurisdiction of the courts of the jurisdiction of the registered office of B’Compliance Advisory. By placing an order on our website, for all disputes, even in the case of multiple defendants and/or plaintiffs, you expressly accept that the competent jurisdiction will be that of the location of the registered office of SASU B’Compliance Advisory.

You agree that we may collect, store and use information about you in accordance with our privacy policy. You acknowledge and agree to be bound by the terms of our Privacy Policy.

We do not provide services for the following activities: Websites with adult content, Pornography, All finance related activities, All licensed activities, Brokers, Alternative payment systems (E-pay) companies, Churches and charities, Commodity trading (oil, diamonds, metals).

Cryptocurrencies, Financial services requiring a licence, BG, SBLC, MTN, Financial instruments, Futures trading, Gambling, Online casinos

Insurance companies and brokers, Mutual funds and hedge funds, Pharmaceuticals (including food supplements), Precious metals, Securities trading, Sale of false diplomas, Trusts

Weapons / weapons handling

Any credit will be used in priority to pay for the following services: registered office address, annual company confirmation, company renewal, etc. If you have not objected, the renewal of your company’s annual fees will be automatic.You may change your personal details at any time or delete all information from our database. To do so, please contact B’Compliance Advisory as soon as possible. You will find its contact details in the contact form and/or in the legal notice. If necessary, contact us at [email protected]

All paid orders are non-refundable. An order is effective immediately, we start processing it as soon as we receive it, which is why we cannot refund it. If the customer cancels an order, we will issue a credit note.

The right of withdrawal may be waived or may not exist in certain cases, in particular: services that must be provided by a specific date or period.

By ordering a Company incorporation service from us, you have expressly requested that we take immediate charge of your order. This is indicated on the order form that you validated.

Exclusion from the withdrawal period

The withdrawal period does not apply in the following situations:

The service is completed before the end of the 14-day period

“…the consumer who requests immediate performance before the end of the withdrawal period effectively waives the right of withdrawal”.

“…certain contracts, by their very nature, cannot be cancelled. In such cases, the consumer must expressly waive his right of withdrawal in order to conclude the contract”.

https://www.legalplace.fr/guides/renoncement-express-droit-retractation/amp/

Article L221-25

Amended by Order no. 2021-1734 of 22 December 2021 – art. 6

“If the consumer wishes the performance of a service or a contract referred to in the first paragraph of article L. 221-4 to begin before the end of the withdrawal period provided for in article L. 221-18 and if the contract requires the consumer to pay, the trader shall obtain the consumer’s express request by any means for contracts concluded at a distance and on paper or on a durable medium for contracts concluded off-premises…”

https://www.legifrance.gouv.fr/codes/section_lc/LEGITEXT000006069565/LEGISCTA000032221365/

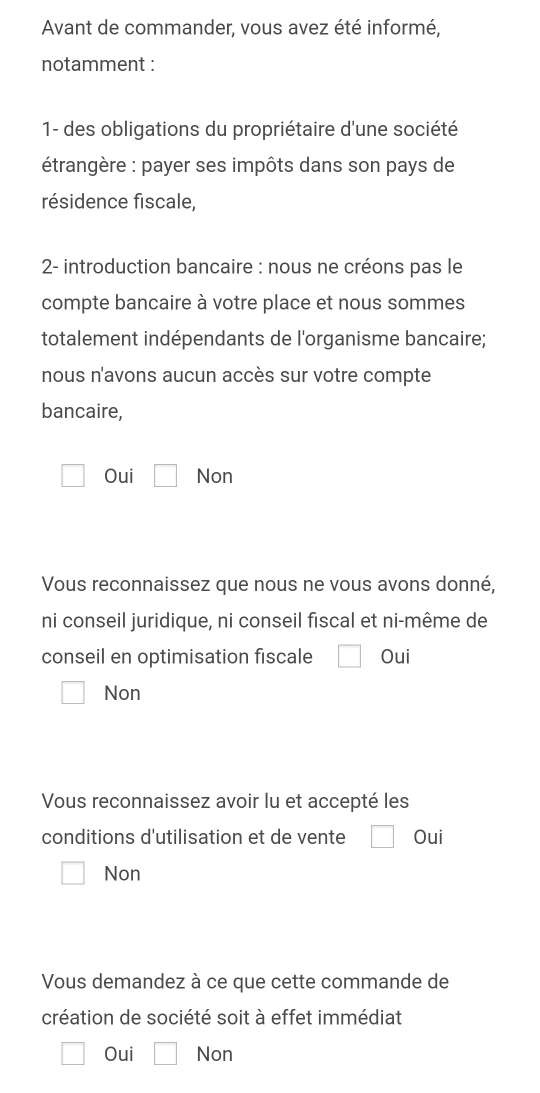

Phase 1: During your first visit to our website, in order to continue your visit, you clicked on the acceptance box for our conditions of use and sale. A link to our Terms and Conditions of Confidentiality, Sale and Use enabled you to read all of these conditions before clicking on “Accept” and continuing your visit, or even placing an order.

Our conditions of sale stipulate that, in view of the foregoing and the following, we only accept orders with immediate effect, and that we cannot therefore refund an order. We can, however, issue a Credit Note.

On our website, the creation of a Company incorporation is by definition immediate. That’s why you placed your order with us. You appreciate our responsiveness and the express handling of your order. By clicking on the boxes specific to the immediate effect of your order, you are declaring that your need is urgent and that we cannot begin to take charge of your Company incorporation until the end of the 15-day cooling-off period.

Phase 2: You are expressly informed, as a reminder, of our terms and conditions of sale and the specific nature of the immediate effect of the order, before placing your order.

Step 3: Then, when you place an order, you can specify in advance, by clicking in the box (yes), whether your order is effective immediately.

If you do not click on this box (yes), we will wait until the end of the withdrawal period (15 days) or we reserve the right to begin providing the service under the provisions of the Consumer Code: in the event of withdrawal, an amount due will be determined in proportion to the work carried out from the day of your order and the day of your withdrawal (sent by e-mail to [email protected]).

We receive your order, with the details that you have accepted:

Phase 4: Your acceptance of the handling of your order, with immediate effect, is all the more effective when you return the Company incorporation form to us, since here again, you wish and declare that we will handle your Company incorporation order immediately: here too, if you wish your order to be handled immediately, you must select the “yes” field, e.g. :

If you indicate “yes” in the response fields, we will receive your answers as follows:

However, phase 3 or 4, as defined above, is sufficient to officially and expressly formalise your request to take charge of your order, with immediate effect. The 2 phases do not have to be combined: a single phase (request) on your part to take immediate charge of your order gives us the legitimacy to take immediate charge of your order.

Bank introduction :

We do not open bank accounts for our customers, we do not sign any documents on their behalf and we do not provide them with any bank identifiers whatsoever; we provide a link enabling the customer to submit to the bank their application to open a bank account; when a person calls the customer to open a bank account, that person is independent of our company and works on behalf of the bank.

By subscribing to at least one of our services, you confirm that we are in no way involved in the management of your company or companies.

Guarantee of registration of your company: provided that you supply us with the information and supporting documents requested, as well as the notarised certificate for certain countries (Bulgaria, Hungary, Holland (Netherlands), etc. (ask us for the list of countries concerned) and that you travel (Germany, Spain, Portugal, etc. (ask us for the list of countries concerned).

Satisfaction or your money back guarantee: registration of your company with a Satisfaction or your money back guarantee, subject to our receipt of the Company incorporation form, duly and fully completed by the customer, accompanied by a scan of the valid passport or identity card certified at the town hall or notary’s office, and proof of address less than 3 months old (landline or cell phone bill or electricity bill or equivalent, in French or English), for each of the directors, partners and members. Subject to the customer providing proof of identity and incorporation documents, legalized by a Notary, and to the customer travelling to the country of incorporation.

Deposit of share capital not included.

VAT number not supplied, except in Bulgaria.